This site is published for residents of the United States who are accredited investors only.

The value of the investment may fall as well as rise and investors may get back less than they invested. Alternative investments have higher fees than traditional investments and they may also be highly leveraged and engage in speculative investment techniques, which can magnify the potential for investment loss or gain and should not be deemed a complete investment program. They are not tax efficient and an investor should consult with his/her tax advisor prior to investing. Alternative investments are often sold by prospectus that discloses all risks, fees, and expenses. Investing in alternative assets involves higher risks than traditional investments and is suitable only for sophisticated investors. Hypothetical example(s) are for illustrative purposes only and are not intended to represent the past or future performance of any specific investment. Check the background of this firm on FINRA's BrokerCheck. Investment advisory services are offered through Thornhill Securities, Inc.

Equity securities offered on this website are offered exclusively through Thornhill Securities, Inc., a registered broker/dealer and member of FINRA/ SIPC("Thornhill"). is a website operated by Realized Technologies, LLC, a wholly owned subsidiary of Realized Holdings, Inc.

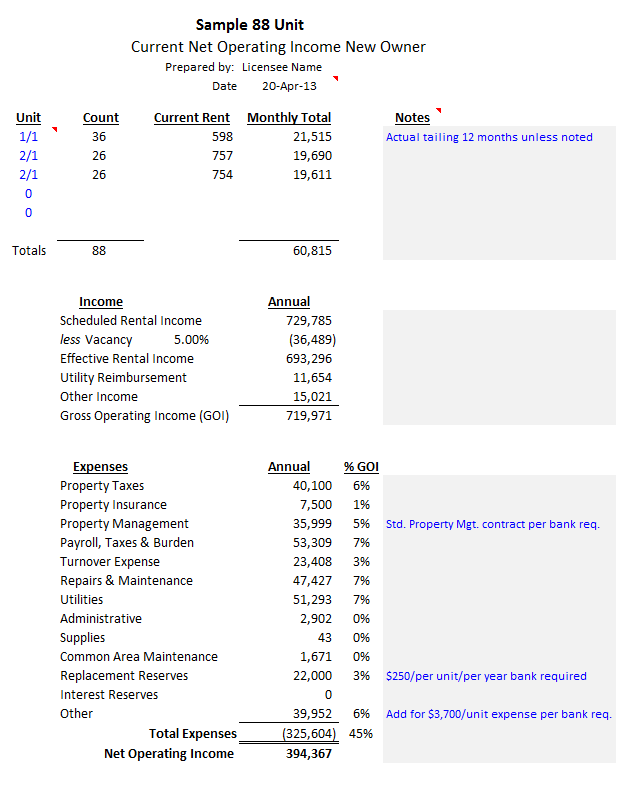

Noi calculation real estate professional#

This material is not a substitute for seeking the advice of a qualified professional for your individual situation. Realized does not provide tax or legal advice. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. Information is based on data gathered from what we believe are reliable sources. This material is for general information and educational purposes only. To understand what expenses to use in calculating NOI, it is always best to consult with a financial advisor. If a property is operating at a loss, it is referred to as a net operating loss. If necessary operating expenses are $25,000, the NOI would be $20,000.Įvaluating the NOI of a property can help investors gauge whether it might be a strong income producing investment after considering the necessary expenses to run the property.

The effective rental income would be $45,000. However, two units sit unoccupied, totaling $5,000 in vacancy losses. This might include:Ĭapital expenditures differ from maintenance and repair and include major upgrades like a new roof or air conditioning unit.Ĭonsider a 20-unit rental property that has a potential rental income of $50,000 if there are no vacancies. The calculation does not include expenses that are not related to the day-to-day operations of the building. It does not consider rent from units that are unoccupied or tenants who fail to pay.Įxamples of necessary operating expenses for an investment property include:

The NOI only includes the effective rental income, which is the amount of rent actually being collected. Income from laundry or vending machines.For example, when considering the income of a property, the following are usually included: Income from a property includes the money coming in from the day-to-day business operations. The calculation is done by taking the revenue earned from the real estate investment minus any operating expenses. To consider the potential profitability of a real estate investment, there is a calculation called the net operating income (NOI).

0 kommentar(er)

0 kommentar(er)